Jorge Miralles Filippini

Quantitative Finance | MSc. in Computational Mechanics

Quantitative engineer with a background in applied mathematics, risk modelling, and computational finance. I combine experience in software engineering and mathematical modelling to build data-driven tools for pricing, volatility, and portfolio risk analysis.

MSc in Computational Mechanics (TUM) and Master’s in Quantitative Finance (UNED). Skilled in Python, C#, Monte Carlo simulation, GARCH/EVT, and numerical optimisation.

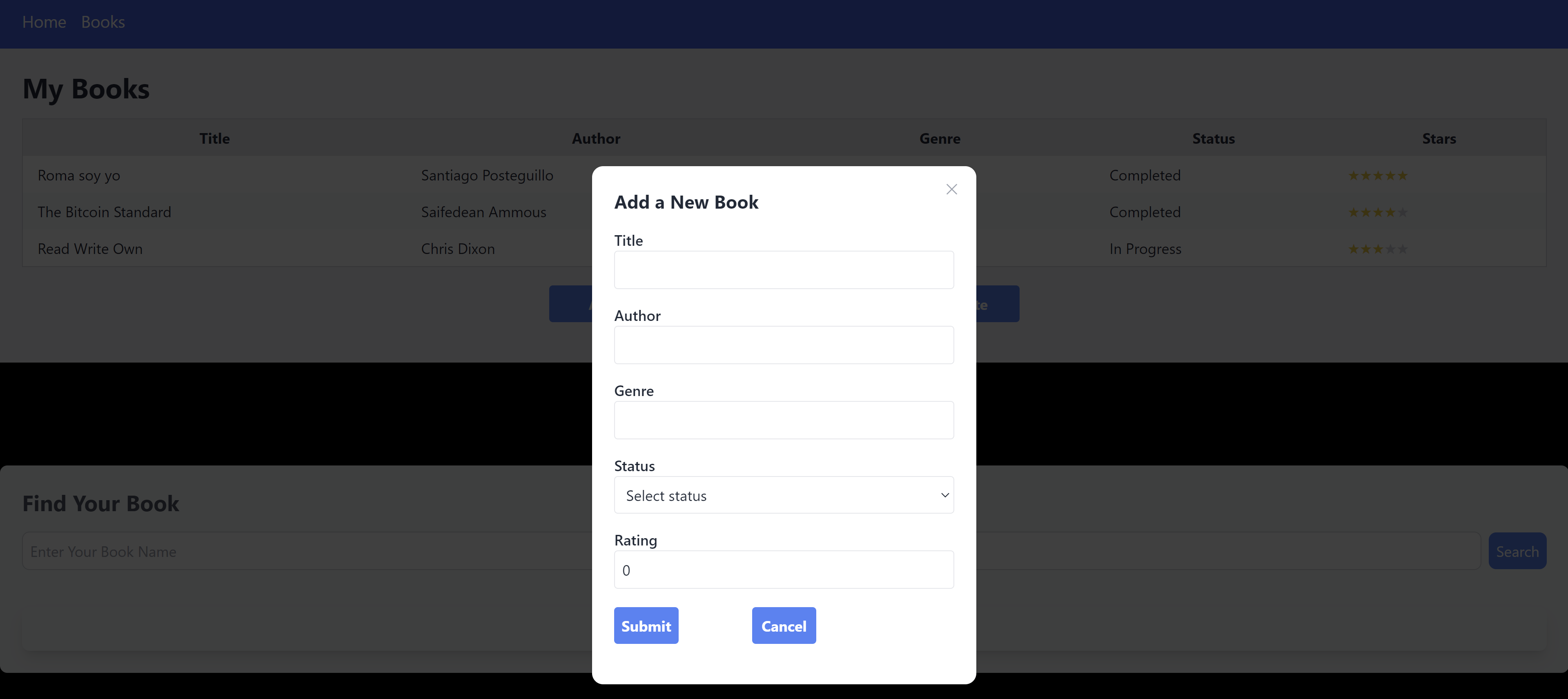

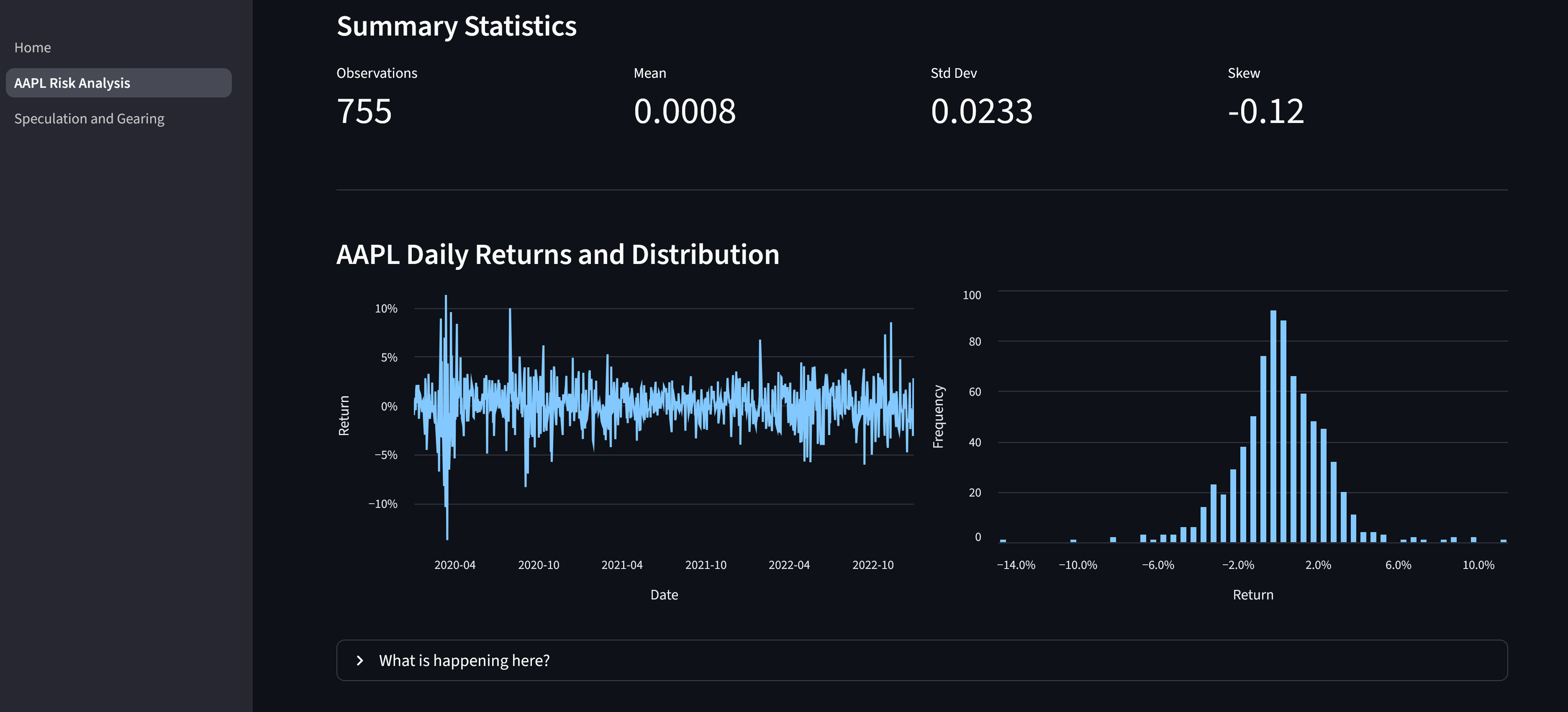

My Quantitative Finance Projects

Interactive Risk & Portfolio Analysis Dashboards

A collection of Python-based dashboards for quantitative finance, integrating econometric modeling, simulation, and interactive data visualization through Streamlit.

PythonFinancial EconometricsRisk ModelingVolatility ModelingPortfolio OptimizationMonte Carlo SimulationDerivatives PricingTime Series Analysis

Other Projects

Experience

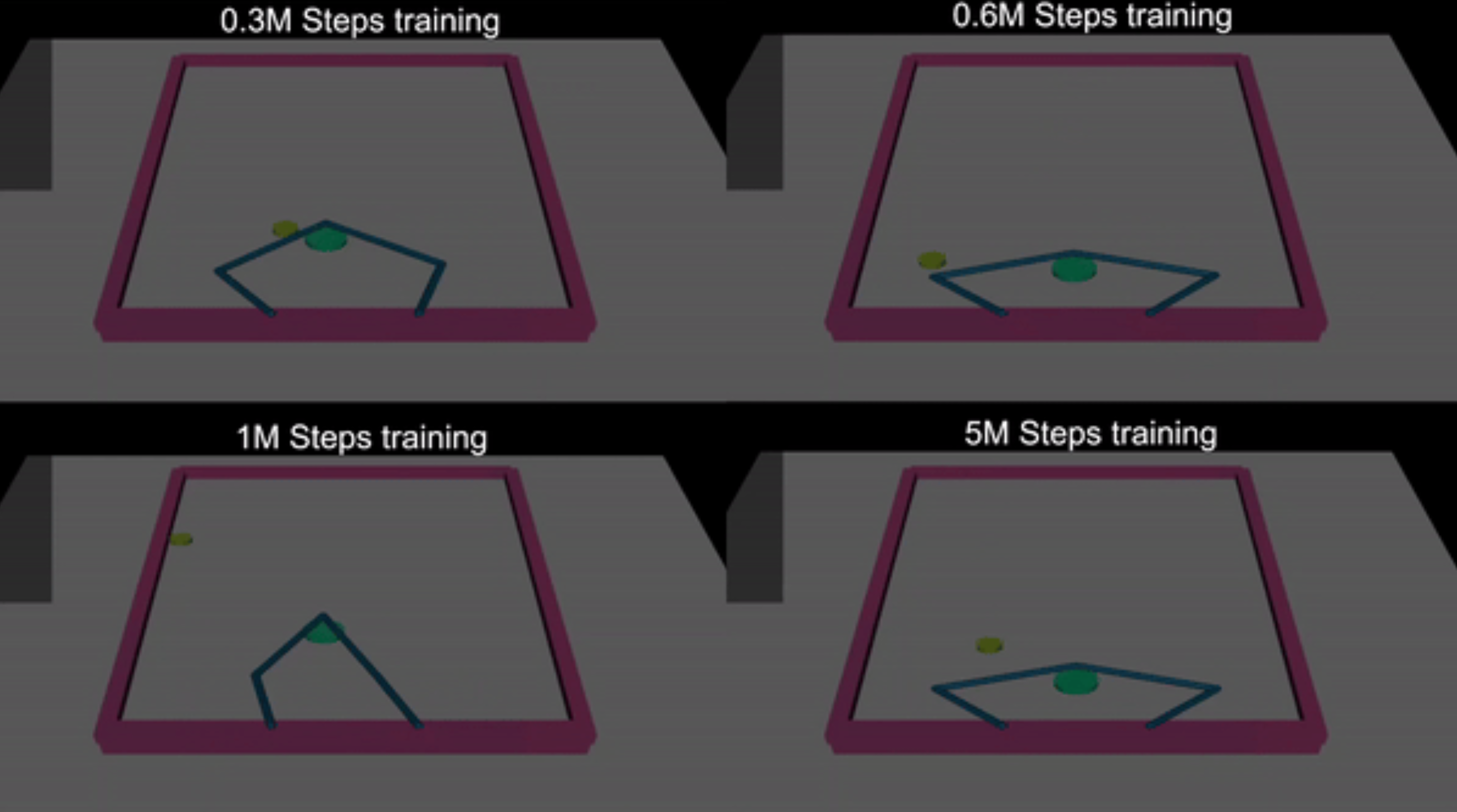

Software Engineer/Consultant — ITQ GmbH

Munich, Germany | 2022–Present

Developed analytical and simulation frameworks in C# and Python for complex decision-making systems. Applied reinforcement learning, numerical optimisation, and time-dependent modelling to improve algorithmic performance. Designed scalable architectures in .NET and delivered data-driven interfaces using Angular and Node.js.

PythonC#.NET 8Reinforcement LearningNumerical OptimisationTime-Series ModellingAngularNode.jsPostgreSQL

C++ Tutor — Technical University of Munich (Chair of Computational Mechanics)

Munich, Germany | 2021–2022

Taught object-oriented C++ to master’s students, focusing on algorithm design, numerical methods, and simulation programming. Supervised projects bridging mathematical modelling and efficient scientific computing.

C++Numerical MethodsScientific ComputingAlgorithm Design

Education

Master in Quantitative Finance (UNED)

Madrid, Spain (Remote) | 2024–2025

Completed a Master’s in Quantitative Finance with focus on Focus on financial econometrics, quantitative modelling, and computational methods for asset pricing and risk management. Built Python models for risk analysis (VaR, GARCH, EVT) and derivatives pricing (Black–Scholes, binomial trees, Monte Carlo).

Financial EconometricsDerivativesRisk ModellingVarEVTAsset PricingTime SeriesPython

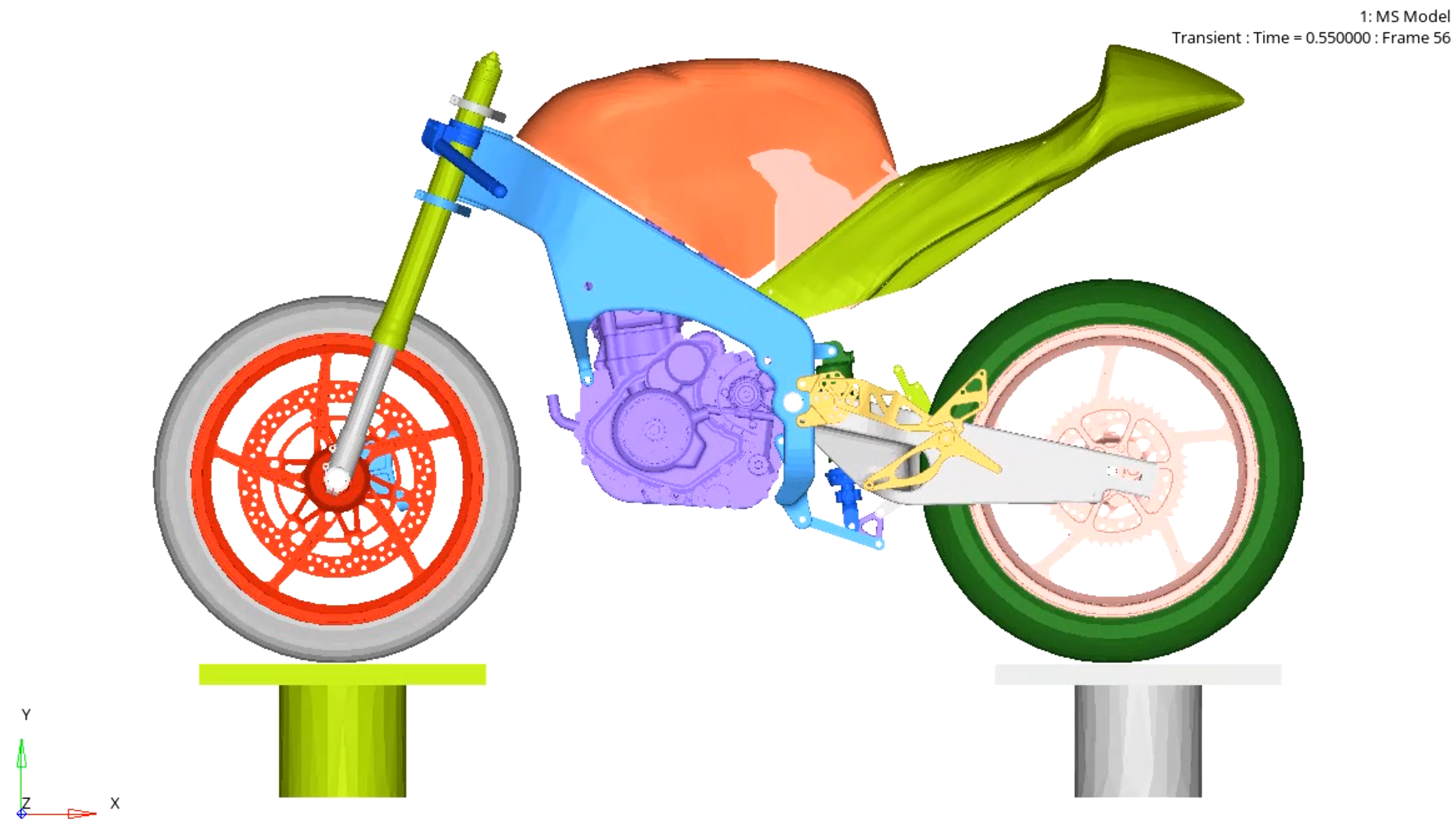

MSc in Computational Mechanics (TUM)

Munich, Germany | 2020–2022

Focus on applied mathematics, numerical methods, stochastic modelling, and HPC for simulation and risk analysis. Thesis: “Reinforcement Learning in Simulated Environments for Robot Control.”

Applied MathematicsNumerical MethodsHPC (MPI/OpenMP)FEMC++/C#PythonComputational Linear AlgebraReinforcement Learning

ERASMUS – TU Dresden

Dresden, Germany | 2019–2020

One-year ERASMUS exchange at TU Dresden; broadened academic scope in a German technical environment.

Numerical MethodsMATLABFEM

BEng in Mechanical Engineering (UC3M)

Madrid, Spain | 2016–2020

Bilingual programme (English/Spanish) with strong fundamentals in mechanics and simulation.

Structural AnalysisThermodynamicsFluidsMATLABEngineering Design

Timeline-Credits: https://github.com/alekspopovic/timeline/tree/master